Global LNG shipments in 2023 grew by 3.4% compared to the previous year, according to statistics from the Organization of Arab Petroleum Exporting Countries' (OAPEC) LNG market report.

OAPEC figures show that global LNG imports hit a record high of 409.3 million tonnes last year.

The Asian market dominated imports, with China, Japan, and South Korea accounting for the lion's share. LNG imports into the Asian market rose by 3% to 261.6 million tonnes last year, compared to 2022.

In Europe, including Tükiye and the UK, LNG imports totaled 126 million tonnes last year, up 0.07% from 2022.

However, excluding Türkiye and the UK, the EU's LNG imports climbed by 4.9% year over year in 2023, reaching 100.3 million tonnes.

US LNG accounted for 48% of Europe's LNG import portfolio, totaling 60 million tons. Russia followed with a 13% share, Qatar with 12%, and Algeria with 8%, while other countries also contributed to the remainder.

North and South America's LNG imports increased by 8.3% to 13 million tonnes, although the Middle East's imports decreased by 8% to 6.6 million tonnes.

Natural Gas, LNG and Hydrogen Expert at OAPEC, Wael Hamed Abdel Moati, stated in the report that the increase in global LNG imports was due to the increase in Chinese demand in Asia.

"China's demand increased by more than 13% on an annual basis compared to 2022, which enabled China to overtake Japan and become the largest market in the global LNG market again."

While the EU's overall LNG imports have increased as a result of Germany's orientation toward a new LNG market to meet its natural gas needs, he said that in general, the Asian market is the main route of LNG shipments, with a 64% share of total global demand, followed by Europe with 31% and other markets with 5%.

- US becomes 2023 LNG export leader

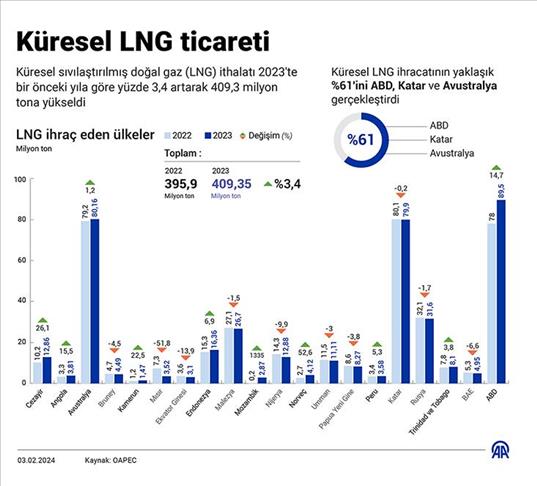

While the US, Qatar, and Australia accounted for approximately 61% of global LNG exports last year, the US exported the majority at 89.5 million tonnes.

On the global LNG market, Algeria, Angola, Cameroon, Indonesia, Mozambique, Norway, and the US were among the countries that saw increases in their exports last year.

The Russia-Ukraine war has significantly affected LNG markets worldwide with increased competition, the consequences of which have been expanded liquefaction capacity at LNG terminals and Qatar ramping up production.

According to the report, the Doha government aims to complete the expansion of the North Field oil and gas project in 2027 and increase the liquefaction capacity from 77 million tonnes to 127 million tonnes to once again rank as the world leader in LNG exports.

LNG Exporting Countries | 2022 (million tonnes) | 2023 (million tonnes) | Percentage |

Algeria | 10.2 | 12.86 | 26.1 |

Angola | 3.3 | 3.81 | 15.5 |

Australia | 79.2 | 80.16 | 1.2 |

Brunei | 4.7 | 4.49 | -4.5 |

Cameroon | 1.2 | 1.47 | 22.5 |

Egypt | 7.3 | 3.52 | -51.8 |

Equatorial Guinea | 3.6 | 3.1 | -13.9 |

Indonesia | 15.3 | 16.36 | 6.9 |

Malaysia | 27.1 | 26.7 | -1.5 |

Mozambique | 0.2 | 2.87 | 1335 |

Nigeria | 14.3 | 12.88 | -9.9 |

Norway | 2.7 | 4.12 | 52.6 |

Oman | 11.5 | 11.11 | -3 |

Papua New Guinea | 8.6 | 8.27 | -3.8 |

Peru | 3.4 | 3.58 | 5.3 |

Qatar | 80.1 | 79.9 | -0.2 |

Russia | 32.1 | 31.6 | -1.7 |

Trinidad and Tobago | 7.8 | 8.1 | 3,8 |

United Arab Emirates | 5.3 | 4.95 | -6.6 |

USA | 78 | 89.5 | 14.7 |

Total | 395.9 | 409.35 | 3.4 |

By Fuat Kabakci

Anadolu Agency

energy@aa.com.tr