By Gulbin Yildirim, Bahattin Gonultas and Gokhan Kurtaran

WASHINGTON/LONDON/BERLIN

The recent arrest of a top executive of Chinese tech giant Huawei may not only derail trade negotiations between the U.S. and China but could also set a new norm that makes international business

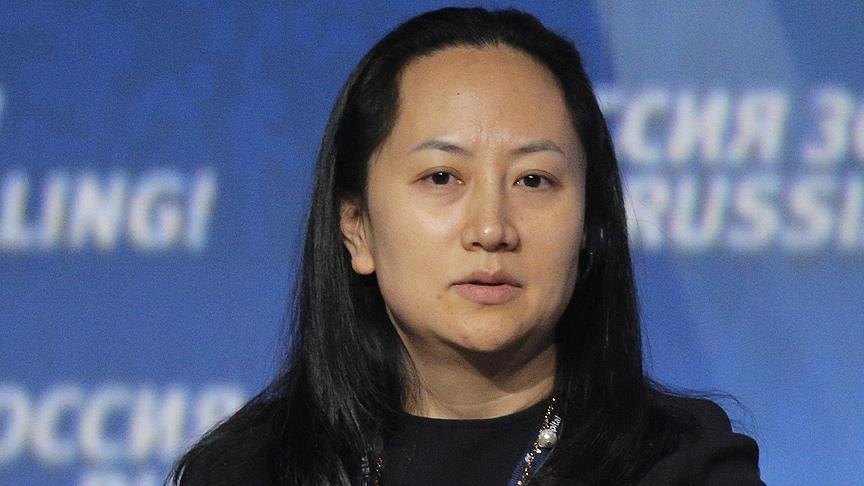

The high-profile arrest of the company’s chief financial officer, Meng Wanzhou, who is also the daughter of Huawei’s founder and chief executive Ren Zhengfei, is continuing to pressure global markets as Meng’s bail hearing drags on in British Columbia, Canada.

Meng was arrested on Dec. 1 by Canadian police while changing planes at Vancouver International Airport at the request of U.S. authorities.

The U.S. alleges that she covered up Huawei's links to a Hong Kong-based company doing business with Iran in violation of U.S. sanctions.

China and Huawei reject the claims, insisting that Meng has not broken any American or Canadian laws.

After harsh statements demanding Meng’s release failed to bear any fruit, China's Foreign Ministry summoned the U.S. envoy to Beijing on Sunday and demanded that Washington cancel an order for her arrest.

‘Same thing will happen with EU’

Steve Hanke, a professor of applied economics at John Hopkins University and senior fellow at the Cato Institute, told Anadolu Agency that Meng's arrest would potentially affect the trade war between the U.S. and China.

“It sure affects the trade war,” Hanke warned. "The idea that these -- U.S.-China trade negotiations and Meng's arrest -- are separate matters is ridiculous," he added.

U.S. Trade Representative Robert Lighthizer said recently that U.S.-China negotiations should not be impacted by the controversial arrest because it "is a criminal justice matter" and "totally separate from anything I work on or anything that trade policy people in the administration work on".

Hanke also pointed out that the Huawei investigation could set an example for other companies doing business in Iran.

“The same thing will happen with the EU trying to get around the secondary sanctions the U.S. threatened to impose on European companies if they have any dealings with Iran,” he said, adding it would create all kinds of problems between the U.S. and the EU.

The transatlantic relations have deteriorated since U.S. President Donald Trump took office back in January 2017. With Trump's 'America First' agenda, the U.S. and the EU found themselves at odds on several areas such as climate change, the Iran nuclear deal

Shortly after the U.S. pulled out of the Iran nuclear deal, signed between Iran and the P5+1 -- the U.S., Britain, China, France, Germany, and Russia -- leaders of the EU activated legislation banning companies in the bloc from complying with U.S. sanctions against Iran.

But the measure failed to prevent many large European companies including Total, Volkswagen, Daimler, Peugeot, Renault and Siemens from withdrawing from Iran.

A very heavy measure

The motivation of the U.S. for arresting Meng at an important juncture in the U.S.-China trade war is also a question mark for many.

“It is quite an extraordinary issue to arrest the CFO of one of the biggest

"Arresting the CFO for that issue seems a very heavy measure,” he said.

According to Meer, the Huawei arrest marks a new stage in the mix of technological/geopolitical/economic rivalry between the world’s largest economies.

However, the reaction of the media and

“If this would happen to a CFO of a big U.S. company like Google, Microsoft or Facebook on the request of China, public opinion in the USA would be very upset as well. This is not the way you deal with big multinational companies normally. It looks more like bullying than effectively influencing the policies of the company,” he said.

He warned that U.S. treatment of Huawei’s CFO could set an example.

“There is a risk that the manner in which the USA deals with Huawei now may set a new norm. Other countries may act more aggressive towards foreign companies they do not like as well,” Meer said. "It will make international business

He suggested that China may try to arrest high-level people from big American companies in retaliation if Meng is not released soon.

"It may start a vicious circle of escalating economic conflict in which no one will win,” he said.

Julian Evans-Pritchard,

“Though the Chinese seem likely to tolerate this transgression if it means clinching a deal on trade,” Pritchard added.

Anadolu Agency website contains only a portion of the news stories offered to subscribers in the AA News Broadcasting System (HAS), and in summarized form. Please contact us for subscription options.