ANKARA

Income and wealth inequalities have been on the rise nearly everywhere since the 80s, said Paris-based World Inequality Lab in its latest report.

The World Inequality Report 2022, released on Tuesday, revealed thought-provoking findings over global income and wealth inequality.

The wealthiest 10% of the global population takes up 52% of the global income, whereas the poorest half earns 8%, it said.

These averages mask wide disparities both between and within countries.

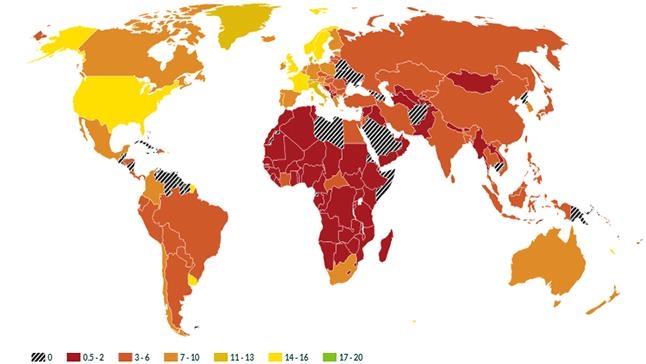

The Middle East North Africa (MENA) is the most unequal region in the world, whereas Europe has the lowest inequality levels, the findings revealed.

Wealth ownership

The poorest half of the global population hardly owns any wealth with just 2%, the report said.

In comparison, the wealthiest 10% of the global population owns 76% of all wealth.

On average, the poorest half of the population owns $4,100 per adult, and the top 10% owns $771,300.

While inequality has increased within most countries over the past two decades, global inequalities between countries have declined.

The gap between the average incomes of the wealthiest 10% of countries and the average incomes of the poorest 50% of countries dropped from around 50 times to a little less than 40 times.

Meanwhile, inequalities rose considerably within countries. The gap between the average incomes of the top 10% and the bottom 50% of individuals within countries has almost doubled, from 8.5 times to 15 times.

Despite economic catch-up and strong growth in the emerging countries, the world remains particularly unequal today, it was stated.

Rise of private wealth

There has been a surge of private wealth in emerging countries like China, Russia, and India.

China and India experienced faster increases in personal wealth after they transitioned away from communism or a highly regulated economic system, the report observed.

China has had the most significant increase in private wealth in recent decades. The personal wealth increase seen in India over this time is also remarkable (up from 290% in 1980 to 560% in 2020).

Richer nations, poorer governments

Over the past four decades, countries have become remarkably more prosperous while their governments have become significantly poorer, the report noted.

The share of wealth held by public actors is close to zero or negative in rich countries, meaning that the totality of wealth is in private hands.

This trend has been amplified by the COVID-derived economic crisis, during which governments borrowed the equivalent of 10-20% of GDP, essentially from the private sector.

The currently low wealth of governments have important implications for state capacities to tackle inequality in the future and the critical challenges of the 21st century, such as climate change.

Impact of COVID on inequality

The COVID-19 pandemic and the economic crisis that followed hit all world regions in varying intensities.

Europe, Latin America, and South and Southeast Asia recorded the most significant drops in national income in 2020 (between -6% and -7.6%), the report said.

However, East Asia, where the pandemic originated, succeeded in stabilizing its 2020 income at the level of 2019.

However, it is still too early for a systematic understanding of the intra-country impact of the crisis on income and wealth inequality owing to the lack of real-time data on the distribution of growth across all countries.

Nevertheless, between 2021 and 2019, the wealth of the top 0.001% grew by 14%, while average global wealth is estimated to have risen by just 1%. In addition, the global billionaire wealth increased by more than 50% between 2019 and 2021.

Anadolu Agency website contains only a portion of the news stories offered to subscribers in the AA News Broadcasting System (HAS), and in summarized form. Please contact us for subscription options.