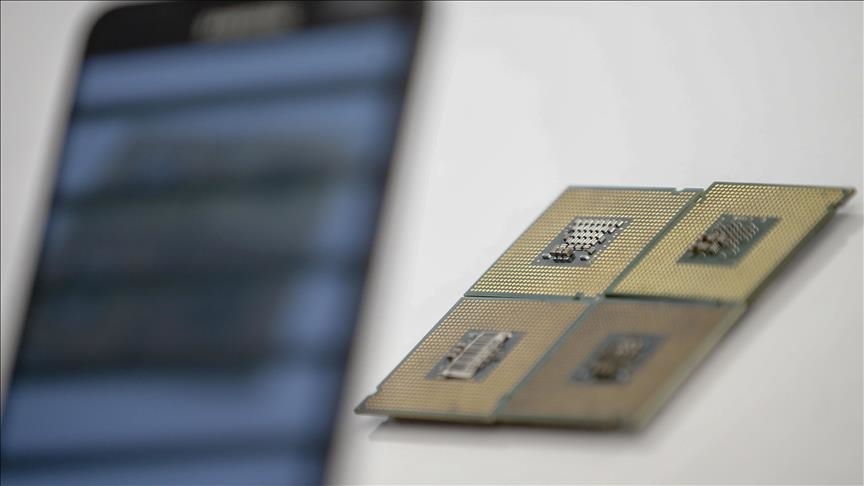

Chinese chipmaker SMIC shares drop over 5% after Q1 earnings miss expectations

China's top chipmaker sees strong profit growth, but warns of lower margins ahead

ISTANBUL

Shares of China’s largest contract chipmaker, Semiconductor Manufacturing International Corporation (SMIC), dropped more than 5% on Friday after the firm’s latest financial results missed market expectations.

SMIC posted a first-quarter revenue of $2.24 billion, marking a 28% year-on-year increase. Profit attributable to shareholders surged 162% to $188 million, the company said in its earnings release Thursday.

Despite the growth, both revenue and profit fell short of analysts’ estimates and the company’s internal guidance, prompting a decline in its stock as of 0730GMT.

For the second quarter, SMIC forecast a sequential revenue decline of 4% to 6% and a drop in gross margin from 22.5% to a range of 18% to 20%.

Still, the company noted robust operational metrics: wafer shipments rose 15% quarter-on-quarter and 28% year-on-year, while capacity utilization improved to 89.6%, up 4.1 points from the previous quarter.

SMIC attributed the increased shipments to changes in geopolitical conditions and government-driven demand boosts, including consumer subsidies and trade-in programs.