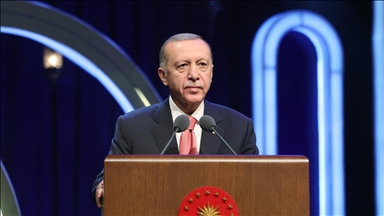

Turkey: Erdogan slams Central Bank’s interest rate cut

"In its struggle for independence against us, has the bank’s dependence gone elsewhere?" the Turkish president asks

ANKARA

President Recep Tayyip Erdogan renewed his criticism of Central Bank of Turkey on Wednesday for not reducing the recently announced interest rates further.

“The bank hiked the rate to 500 base points last year, but its total rate cut stood at 250 points so far," Erdogan said during his meeting with Turkish Merchants and Craftsmen Loan and Bail Cooperatives Union in Ankara.

"We do not have any word for the bank’s independence. But we do not hesitate to say when our country’s interest comes into question. In its struggle for independence against us, has the bank’s dependence gone elsewhere? Its interest rate policy is wrong," he added.

The president is known for his strong opposition to high interest rates and his latest comments come as the Turkish Central Bank trimmed its key interest rate by 25 basis points Tuesday. Erdogan previously said that the high interest rate in the country did not help to boost Turkey's growth.

The bank cut its one-week repo rate to 7.5 percent and lowered its overnight borrowing rate to 7.25 percent. It also cut its overnight lending rate by 50 basis points to 10.75 percent and its primary dealers’ overnight borrowing rate to 10.25 percent.

The president said his insistence (to lower the interest rate) would protect the country’s law.

"The bank interest rate policy does not reflect realities in Turkey. We asked a question if some place took them under their influence?” he said.

The Turkish Central Bank's interest rate cut has been criticized by government officials and business community.

Despite the 0.25 point cut, there was still mounting pressure on the bank for larger rate cuts.

"I did not see courage in Central Bank’s latest decision. The benchmark interest rate of Turkey should be below seven percent and upper limit of the interest rate corridor should be less than 10 percent,” Economy Minister Nihat Zeybekci said Tuesday.

Another government official, Science, Industry and Technology Minister Fikri Isik, said Tuesday: "There was a 50-basis-point reduction in upper limit of the interest rate corridor, but this did not fulfill our expectations. We have been waiting a more decisive reduction," Isik said.

Nail Olpak, head of one of largest business associations in Turkey, MUSIAD, said that the target Gross Domestic Product growth rate was now impossible to reach with current rate reductions.

"The reduction on Tuesday fell short of market expectations," Olpak said.

Anadolu Agency website contains only a portion of the news stories offered to subscribers in the AA News Broadcasting System (HAS), and in summarized form. Please contact us for subscription options.